The Orderflows Absorption Tool For NT8

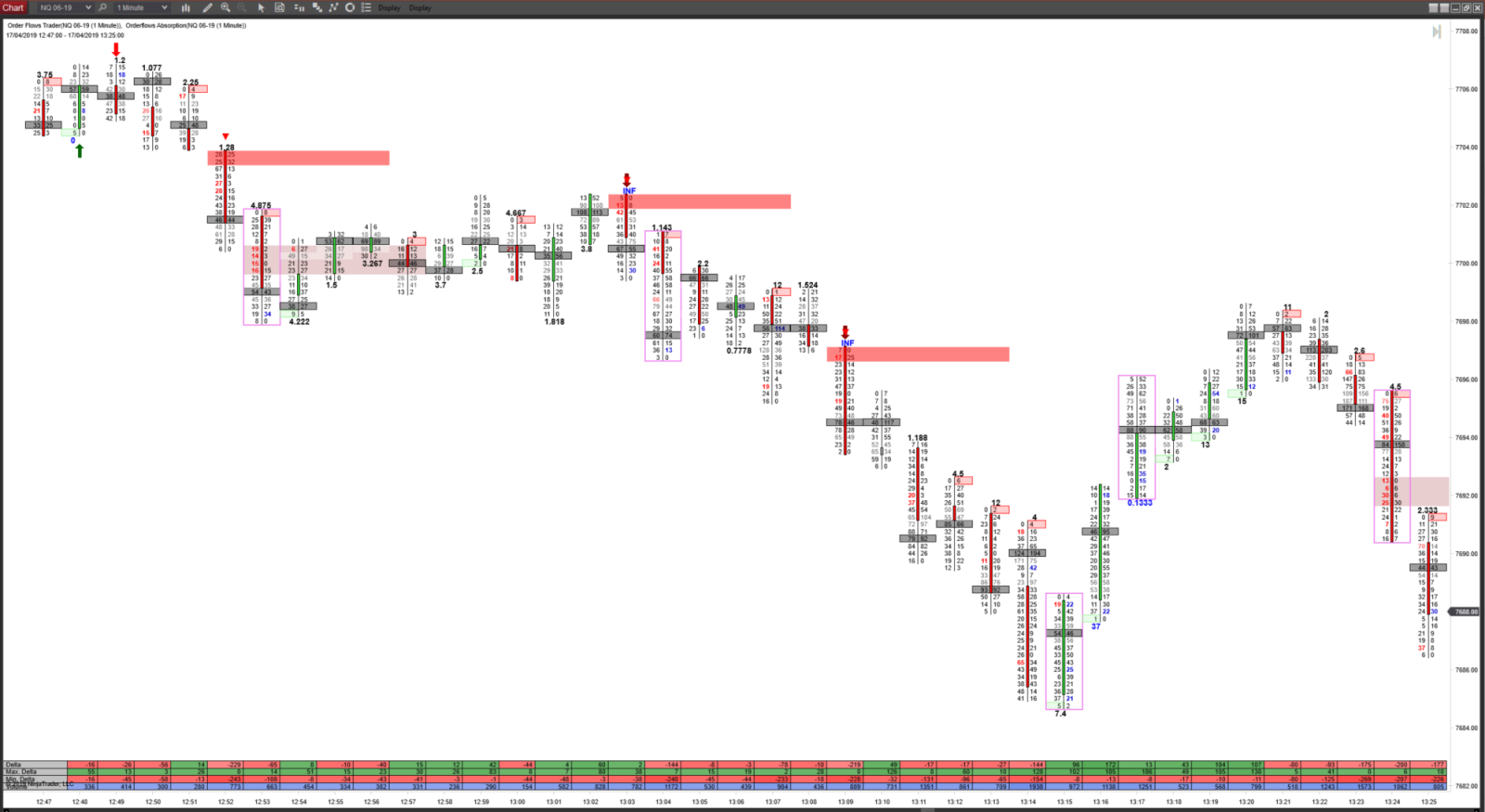

There are 7 different orderflows absorption scenarios programmed in the indicator:

Extreme Absorption – A reversal signal. This scenario occurs when there is absorption at the extreme of a bar. Can be used on any bar type, short term and long term.

Expanded Extreme Absorption – A reversal signal. This scenario occurs when there is absorption near the extreme of a bar. Should be used in conjunction with Extreme Absorption on longer bar periods. For example, 5-minute charts or 10 range bars. Expanded Extreme Absorption looks at additional price levels in determining absorption in a bar. That is why it is recommended to use on longer range bars or bars that cover more price levels.

Momentum Absorption – A continuation signal. When a market is trending or moving quickly in one direction there can be signs of absorptive buying if the market is moving higher or absorptive selling if the market is moving lower. What that means is there is supportive buying on the way up in the sense that there were buyers who were lifting heavy offers. Or on the market moving lower, sellers hitting big bids. Usually the offers and bids are hidden because of the traders hide their size through the use of iceberg orders.

Trapped Absorption – A reversal signal often seen in a pull back, but trapped absorption can occur at a pure reversal or in a move. These are areas where traders are potentially trapped in the market.

Level 1 Aggressive Absorption – A combination of Extreme Absorption and Momentum Absorption. It detects areas where there is absorption of both the bid and offer when the market is not moving.

Level 2 Aggressive Absorption – A combination of Expanded Extreme Absorption and Momentum Absorption. It detects areas where there is absorption of both the bid and offer when the market is not moving but expands the analysis window further.

Stacked Absorption – Combines both Extreme Absorption and Expanded Extreme Absorption but treats it as one level.Each scenario can be enabled or disabled, depending on your trade plan.

Additionally, within each scenario, the user can select a conditional delta volume.

There are also general settings which the user can adjust:

Enable Swing Filter

Swing Period

Minimum Bar Volume Required

Use Delta Confirmation

Use Delta Divergence

Prominent POC (Point of Control Confirmation)

| Orderflows Absorption User Guide | Download |